In today’s complex financial landscape, investors seek both safety and growth. The core-satellite approach offers a way to harmonize stability and dynamic opportunities, helping you navigate market ups and downs with confidence.

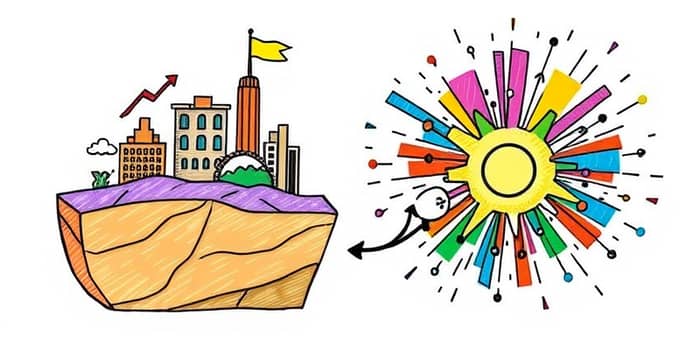

The core-satellite structure divides a portfolio into two distinct components. The “core” provides consistent, market-aligned core foundation through broad, low-cost investments. Satellites add targeted, higher-risk positions to chase outperformance or capture emerging trends.

This philosophy rests on balancing risk and reward. By anchoring the majority of your assets in passive, diversified instruments, you maintain resilience during downturns. Meanwhile, a smaller portion is allocated to opportunistic bets, preserving the potential for superior returns.

At the heart of the core-satellite method lies the core. Typically constituting 70%–90% of your portfolio, the core invests in:

These assets deliver broad market exposure, tax efficiency, and minimal fees. Over the long term, they act as the bedrock of your wealth accumulation strategy. By prioritizing broad diversification and cost efficiency, the core reduces volatility and smooths returns.

Satellite investments typically represent 10%–30% of the portfolio. They are chosen for their potential to outperform core holdings in bullish markets or exploit specific themes. Satellite options include:

While satellites are less predictable, they inject dynamism and an opportunity for extra gains. The key is to limit exposure so that a downturn in one niche doesn’t destabilize the entire portfolio.

Portfolios can be tailored to risk tolerance and investment horizon. A conservative investor may skew heavily toward the core, while an aggressive investor embraces larger satellites. Below is a table illustrating sample allocations:

Ongoing management is crucial to sustaining your target allocations. Market fluctuations can skew the balance between core and satellites, leading to unintended risk levels.

Adopt these practical measures:

Through disciplined monitoring, you reinforce the long-term stability of your core foundation while preserving tactical flexibility in your satellites.

While the core-satellite model offers a sound framework, common missteps can erode its benefits:

Adhering to these proven best practices and risk controls ensures you harness the full potential of the approach without exposing yourself to undue stress.

Implementing a core-satellite portfolio empowers you to pursue growth while maintaining resilience. Start by clarifying your risk tolerance, then allocate the bulk of your assets to a diverse, low-cost core foundation. Next, select a limited range of satellites that reflect your convictions and market insights.

Maintain discipline through regular reviews and rebalancing to preserve your target mix. Over time, this approach can deliver steady, long-term returns with controlled risk. Above all, it fosters a mindset of strategic balance—one that combines the reliability of passive investing with the excitement of targeted opportunities.

In the ever-changing world of finance, the core-satellite structure stands out as a beacon of clarity. It reminds us that true success often lies in equilibrium: a stable base that endures, complemented by the courage to pursue what’s next.

References