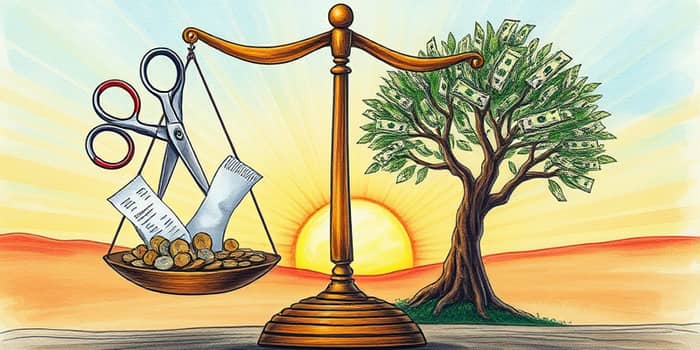

Many people believe that living frugally and cutting back on subscriptions is the silver bullet for debt elimination. While reducing outflows is crucial, it represents only one side of a multifaceted solution. True debt freedom requires balanced strategies that go beyond trimming budgets.

In this article, we explore why expense management alone often hits a plateau and introduce complementary tactics—income growth, restructuring, psychology, technology, and community support—that together forge a sustainable path to financial recovery.

Tracking spending is the first step toward debt recovery. By categorizing transactions and visualizing patterns, you gain clarity on where funds disappear. Many guides recommend the 50-30-20 rule for budgeting: 50% of earnings to necessities, 30% to wants, and 20% to savings or debt repayment.

Practical tactics include:

Automated budget trackers and transaction categorization tools can streamline this process, offering real-time alerts when spending thresholds are breached. However, after initial cuts, many individuals and businesses find themselves in a spending rut, unable to unlock further savings without sacrificing essential quality of life or operations.

Expense reduction sets the stage, but boosting earnings drives the curtain up on real progress. Even modest increases—an extra $200 per month—can accelerate repayment timelines dramatically through compounding effects.

Consider these revenue-boosting ideas:

By pairing disciplined spending with proactive income strategies, you create a dual-pronged assault on debt, amplifying the pace at which balances shrink.

Once you’ve tightened belts and tapped new revenue streams, the next focus is on optimizing how you service what remains. Two popular repayment frameworks are the debt snowball and the debt avalanche methods.

The debt avalanche method minimizes total interest by targeting the highest-rate accounts first, while the snowball approach builds psychological momentum by paying off smaller balances. For many, a hybrid tactic yields the best blend of savings and motivation.

Consolidation loans or balance-transfer credit cards can simplify payments and lower rates. Businesses may refinance existing loans or negotiate extended terms. In some cases, lenders agree to reduced principal settlements when faced with well-documented hardship.

Here’s a quick comparison:

Money matters are never purely mathematical; emotions and habits play pivotal roles. Stress, shame, and avoidance can derail even the most logical plans.

Implement positive reinforcement to sustain motivation. Celebrate milestones—no matter how small—with non-monetary rewards. Visual progress charts, community shout-outs, or simple self-acknowledgment can fuel ongoing commitment.

Support networks—online forums, peer groups, or local workshops—offer accountability and encouragement. Sharing wins and setbacks normalizes struggles and diffuses isolation, making it easier to persevere.

Digital tools are game-changers in proactive debt management. Analytics and receivables scoring systems detect risk patterns before they escalate into defaults, empowering businesses to intervene early.

Automated reminders, online payment portals, and mobile apps streamline collection efforts and reduce administrative friction. For individuals, apps that sync bank accounts and credit reports offer integrated dashboards where budgets, debts, and upcoming payments are visible at a glance.

No one recovers in isolation. At times, professional or community support is invaluable. Credit counseling agencies can negotiate with creditors on your behalf, often arranging reduced interest or extended payment plans.

Government-sponsored loan schemes, relief grants, and cooperative recovery programs may provide breathing room through payment holidays or low-interest refinancing. Always vet providers carefully and understand all terms before committing to specialized services.

Expense cutting lays the groundwork, but to propel yourself toward genuine freedom, you must engage all facets of debt recovery. Integrate spending discipline with deliberate income generation, strategic restructuring, behavioral reinforcement, technological tools, and external support.

By addressing both halves of the equation, you not only accelerate paydown schedules but also build lasting financial resilience. Remember: sustainable debt recovery is a journey of balanced action, unwavering focus, and continual adaptation.

References