Navigating unpredictable markets requires more than intuition—it demands a structured approach to understanding how your investments might behave under pressure. By stress testing your portfolio, you can reveal hidden vulnerabilities before losses occur, ensure your strategy aligns with your goals, and build confidence even when volatility strikes.

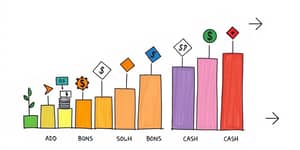

The foundation of any meaningful stress test is comprehensive data collection. Start by cataloging every holding in your portfolio, from traditional stocks and bonds to real estate, alternative strategies, and cash positions.

Key elements include:

This granular view highlights concentration risks. For example, an overweight in technology stocks or emerging market debt can expose you to synchronized downturns. Tracking past drawdowns and recovery times also helps you quantify potential losses and recovery times when markets turn against you.

Mapping liquidity characteristics is equally crucial. Identify assets that require long liquidation periods or have minimum holding terms, which could force sales at unfavorable prices in a crisis.

With your data in place, it’s time to simulate adverse conditions. Scenarios can be drawn from history, imagined hypotheticals, or stylized shocks. Each type reveals different insights:

Implement these scenarios using professional software or analytical platforms—tools such as BlackRock’s Aladdin or Moody’s Analytics provide robust engines and preset case studies. Input your actual portfolio data and run each simulation to capture:

This process helps you understand how shocks ripple through your holdings and where the most significant risks lie.

Data without a plan is wasted effort. After running your scenarios, analyze the outputs with a critical eye. Look for:

Identify the weak links—those holdings or exposures driving outsized losses. Then, consider practical adjustments:

- Rebalance to reduce concentration in volatile sectors or geographies.

- Introduce hedging instruments such as options, inverse ETFs, or additional cash buffers.

- Adjust durations in your fixed income portfolio to manage interest rate risk.

Document your decisions and establish clear thresholds for action. For example, if any scenario predicts a loss greater than 20%, set an automatic review to trigger rebalancing or hedging steps. Treat stress testing as an ongoing iterative risk management process, repeating it quarterly or whenever significant life or market events occur.

Stress testing is not a one-off task; it is a commitment to continuous improvement. By following these three steps—data gathering, scenario application, and decisive action—you create a dynamic framework that adapts to market shifts and aligns with your long-term objectives.

Beyond uncovering vulnerabilities, this discipline fosters a deeper understanding of your portfolio’s behavior under duress. It empowers you with the foresight to make proactive adjustments to evolving market conditions and to align strategy with risk tolerance, ensuring you can safeguard wealth against unforeseen crises.

Embrace stress testing as a cornerstone of your investment process, and you’ll move forward with both aspiration and assurance—ready to face whatever the markets bring.

References