Amid today’s turbulent financial landscape, portfolio managers face an urgent challenge: ensuring resilience when consecutive market shocks collide. Stress testing under back-to-back downturn scenarios is not a luxury but an imperative practice that can identify vulnerabilities and guide adjustments before losses become catastrophic. By embracing sophisticated modeling and informed judgments, investors can navigate compounded risks and emerge with stronger positions.

Stress testing evaluates a portfolio’s performance under severe but plausible market events that may not be captured by standard volatility models. Rather than rely solely on historical averages or short-term fluctuations, a stress test challenges assumptions and forces an honest look at potential weak points.

Institutional investors, regulators, and banks increasingly mandate these exercises to:

Far from being an academic exercise, stress testing ensures that portfolios are not only built for growth but also fortified against unexpected storms.

Traditional stress tests focus on a single shock, but modern dynamics demand serial or overlapping stress periods. A back-to-back scenario might begin with a sudden market crash, followed by a prolonged recession, and then an interest rate shock. Each phase can exacerbate losses and test recovery strategies.

Historical precedents offer key lessons: the 2020 COVID-19 crash rapidly transitioned into inflationary pressures in 2021 and 2022, while the 2008 financial crisis saw cascading credit events before any meaningful bounce-back. To capture these dynamics, portfolios must endure compound layers of economic stress, where correlations spike and liquidity evaporates.

Effective stress testing blends historical and hypothetical cases. Use past crises like 2008 and 2020 to validate models, then introduce novel twists such as prolonged policy paralysis or simultaneous credit and commodity shocks.

Essential modeling steps include:

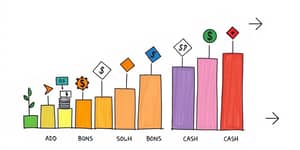

Quantitative metrics provide clarity:

Value at Risk (VaR) estimates the maximum expected loss at a given confidence level, while average loss beyond VaR thresholds captures potential outcomes when VaR is exceeded. Monitoring liquidity and cashflow strains reveals the ability to meet short-term obligations without forced asset sales.

After running simulations, a thorough review determines how each asset class, sector, and geography performs under stress. Look for divergence in returns and changes in volatility that could signal hidden concentration risks or overreliance on crowded trades.

Key considerations include correlation breakdowns between equities and bonds under extreme stress; forced liquidation costs in illiquid markets; changes in hedge effectiveness for options, CDS, and futures; and duration of drawdowns and recovery timelines.

Use results to inform strategic actions such as adjusting risk buffer levels, rebalancing toward defensive assets, and enhancing hedging suites. Communicate findings clearly to governance bodies to align expectations and risk budgets.

Implement both forward-looking and reverse stress tests. Forward stress identifies plausible threats, while reverse stress uncovers the magnitude of shock needed to break the portfolio. This dual approach delivers a robust risk framework.

Follow these steps to integrate stress testing into routine management:

By making stress testing a living process, managers can avoid costly value-destroying overreactions and maintain a disciplined approach to portfolio adjustments.

Back-to-back downturn scenarios are more than theoretical exercises; they expose complex risks that single-event tests may miss. In a world marked by persistent volatility and rapid policy shifts, stress testing must evolve to reflect the reality of serial economic shocks.

Portfolio resilience hinges on a continuous cycle of modeling, review, and action. By embracing rigorous stress tests, investors can build strategies that not only withstand the next downturn but also capitalize on recovery opportunities. With thoughtful preparation and dynamic risk management, portfolios will be well positioned to thrive amid future market challenges.

References